Serendipity Conclave connects anyone who wants to learn about investing with firms that provide investment education. Get started at no cost, and begin the learning journey. Knowledge is power, especially in investing. Serendipity Conclave champions financial literacy, providing a direct link to suitable investment education firms.

The good thing about Serendipity Conclave is learners do not need to pay a fee. Through our service, anyone can develop a solid understanding of investment principles, progressing from foundational concepts to informed decision-making. Sign up for free with Serendipity Conclave and get matched with an investment tutor for personalized training.

Everyone can learn the basics of investment with the necessary training. Serendipity Conclave makes it easy for those without prior knowledge of investment concepts to connect directly with tutors specializing in beginner-friendly education. Take the first step by signing up on Serendipity Conclave.

Serendipity Conclave is not only for newbies. For people who already have a good understanding of the basics, Serendipity Conclave can help them improve their skills. Continuous learning is important in the ever-evolving world of investing, and Serendipity Conclave helps amateur and mid-level investors stay on course.

Through Serendipity Conclave, fairly experienced investors can connect with educators who can seamlessly continue their education, building upon their existing foundation.

Investors that can remain objective in the markets are not so many, and our goal at Serendipity Conclave is to change this as we recognize the importance of financial knowledge and training.

There is no charge for the services we offer, encouraging individuals to learn before entering the investment scene. To get started for free, sign up to Serendipity Conclave.

To sign up on Serendipity Conclave, no payment is required. Full name, other contact details like email, and, importantly, learning preference is all one needs to provide to get started.

Upon registration, users are matched with a suitable education firm tailored to their learning needs and preferences.

After confirming their match, someone from the assigned firm will reach out. This representative will guide them through a smooth onboarding process, and learning can commence immediately.

That's where Serendipity Conclave comes in. Serendipity Conclave creates access to investment knowledge by linking people with suitable tutors, all chosen to match individual learning goals. The focus is on providing essential training to help more people understand and assess investment opportunities. Sign up with Serendipity Conclave for free to begin.

Investing is open to everyone, regardless of background or experience. Why shouldn’t investment education be, too?

Serendipity Conclave promotes diversity and inclusivity, ensuring access to the necessary resources for anyone eager to learn.

Our goal is to liberalize financial knowledge. We cannot do this if we’re restrained by language barriers. Serendipity Conclave’s users can use our site in any language of choice. Numerous options are supported on Serendipity Conclave.

Investing requires dedication and a commitment to learning. Begin the journey by signing up for Serendipity Conclave for free, connecting with investment education tailored to specific learning needs.

The Investment Scene: A World of Opportunities

With limitless possibilities, the financial and investment markets attract all sorts of people.

Risks and Rewards: The Delicate Dance Of Finance

Investments do not guarantee success. So, investment education equips people to manage risks and make informed decisions.

Investing Has A Psychological Component To It

Investors have often found they face more than one hurdle: the markets and themselves. Emotions and biases need to be managed. Investment education sheds more light on this.

Understanding investing principles enables individuals to analyze market trends, evaluate risks, and make informed decisions. Start the journey toward financial literacy by signing up for free with Serendipity Conclave.

We're ready to connect users with suitable tutors the moment they sign up. Whether a beginner seeking foundational knowledge or an experienced investor looking to refine their skills, Serendipity Conclave provides a personalized connection to investment education firms tailored to individual needs. Sign up with Serendipity Conclave for free and get started.

Before investing, it's important to know concepts like portfolio diversification, risk threshold, cash flow, market swings, and phases. These ideas help investors manage exposure and set practical goals. Sign up with Serendipity Conclave to get connected with experts who can explain these topics.

Making investments requires grit, perseverance, and a depth of understanding. Staying updated on market patterns and international happenings helps with adjusting strategies. Learn more after signing up with Serendipity Conclave.

Trading has been around for centuries. It has transitioned from bartering to complex financial markets over time, which offers insights into how modern markets operate.

From the inception of the stock market in the early 17th century to the emergence of trading platforms, financial markets have consistently adjusted to technological progress and economic expansion. Use Serendipity Conclave without paying any fees to explore this further.

Investors have the opportunity to buy shares in companies through the stock market, where prices can change due to factors like demand and supply dynamics and economic conditions at large. These factors drive the performance of a company’s shares up or down over time amidst possible gains and dividends, but with inherent risks and market fluctuations to be mindful of. Interested in knowing more? Use Serendipity Conclave.

Bonds are essentially IOUs issued by governments or companies that may pay investors interest and repay the principal when they mature. The bond market is seen as less risky compared to stocks. It's important to grasp credit risk and how interest rates can change over time to be a bondholder. If interested in this market, sign up on Serendipity Conclave to begin learning.

Commodities refer to materials or essential agricultural products traded in markets such as gold, crude oil, wheat, and cocoa, among others. The prices of commodities are influenced by political occurrences, supply and demand factors, and global economic patterns. Use Serendipity Conclave and learn to make sense of this market.

The Forex market is the biggest and most freely traded financial market in the world, facilitating the exchange of currencies. Traders speculate on the movements of currency pairs influenced by macroeconomic signals, rate trends, and worldwide developments. While Forex trading offers possible rewards, it also carries significant risks. Serendipity Conclave is the place to begin in order to understand this market.

Informed investing requires a thorough understanding of market dynamics, asset classes, risk management, and investment strategies. Serendipity Conclave connects people with education firms that enlighten them on these intricacies.

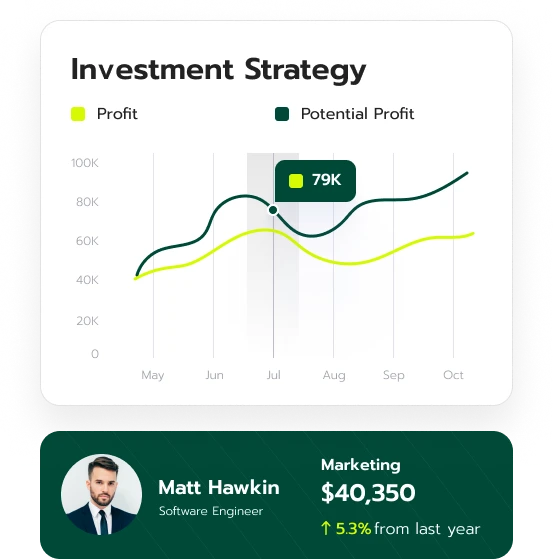

Serendipity Conclave assigns users to appropriate tutors who can help them identify their investment style and develop a personalized investment strategy that aligns with their financial objectives.

Investment strategies should promote discipline, minimize emotional decision-making, and encourage regular review and adaptation based on changing market dynamics.

Investing inevitably involves risks, and understanding these risks is paramount for making informed decisions and managing expectations.

Market risk refers to the potential for investments to lose value due to broader economic factors, such as interest rate changes, recession, or geopolitical events. This risk affects various asset classes differently. Those who sign up on Serendipity Conclave can learn how to manage market risk.

Insolvency risk applies to debt securities, such as bonds, and refers to the possibility of the issuer defaulting on their payments. Understanding credit ratings and assessing the creditworthiness of issuers are essential for mitigating this risk. Sign up for free with Serendipity Conclave to make sense of credit risk assessment.

If it is not easy to buy or sell an investment without the price getting changed significantly, there is a liquidity risk. This risk is common in markets like real estate and private equity. Sign up with Serendipity Conclave to learn more about managing liquidity risk.

Rise in general prices can affect the value of money over time. This risk can reduce the expected returns on an investment. Understanding inflation and its impact on investments is important for making informed decisions. Register for free on Serendipity Conclave and get set up to understand this risk.

This risk occurs when an asset basket is not diverse. Such a portfolio is heavily indexed on an asset, sector, or geographic region. This lack of diversification increases vulnerability to risks associated with that specific investment. Learn more about the importance of portfolio diversification by signing up on Serendipity Conclave.

Also called reinvestment risk, this risk shows up when the proceeds from an investment have to be reinvested at a lower rate than the original investment. This risk affects fixed-income investments the most. Anyone can get a grasp of this risk when they begin the learning journey with Serendipity Conclave for free.

| 🤖 Registration Cost | Free |

| 💰 Fees | No Fees |

| 📋 Registration | Simple, quick |

| 📊 Education Focus | Cryptocurrencies, Forex, Mutual Funds, and Other Investments |

| 🌎 Supported Countries | Most countries Except USA |